Managing super fund liquidity in the midst of COVID-19

It’s no secret that COVID-19 has posed challenges for the superannuation industry. Not since the global financial crisis (GFC) have members – and those entrusted with managing their retirement savings – faced such significant volatility in investment markets and difficult economic conditions. The trustees of APRA-regulated superannuation funds have had to adapt to rapidly changing operating conditions, new policy settings, and unpredictable member behaviour in response to the evolving health and economic crisis.

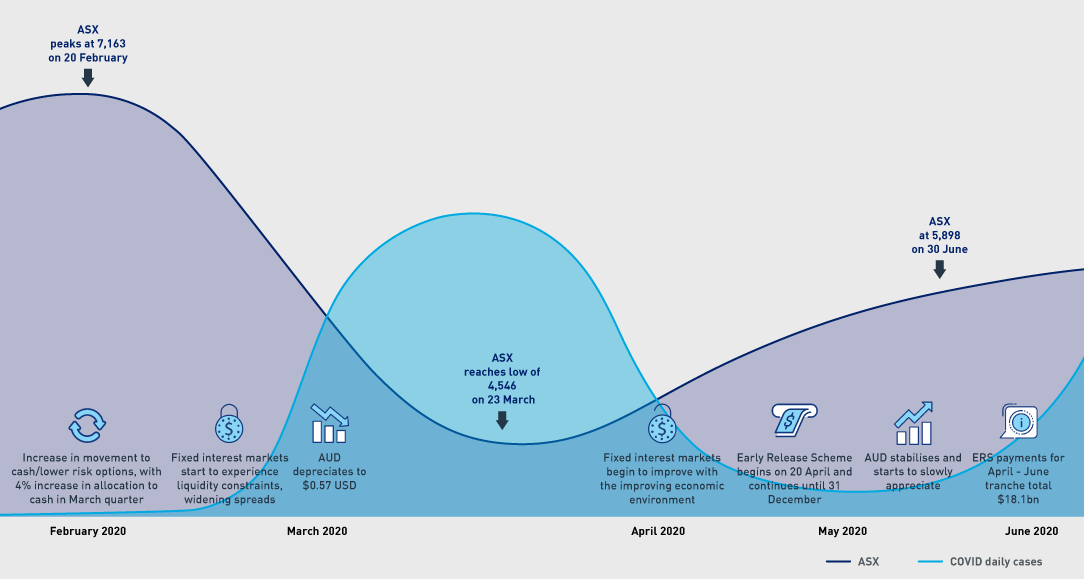

The impacts of COVID-19 created uncertainty in cash flows for super funds – including reduced contributions linked to rising unemployment and financial pressures on employers and members, and outflows associated with the Early Release Scheme – and continues to create additional challenges that funds need to navigate.

There’s no doubt that recent months have highlighted the importance of robust liquidity risk management by superannuation trustees. Overall, trustees have managed liquidity well during this difficult period, although APRA has also identified room for improvement.

Early effects of COVID-19

In the early stages of COVID-19, a range of factors combined to result in heightened financial and non-financial risks for trustees to manage on behalf of their members. From a non-financial risk perspective, business operations were impacted by domestic and overseas health impacts and related restrictions. Business Continuity Management Plans were executed, enabling available resources to continue to be directed towards key member-facing activities, while rapidly shifting companies' operations to be substantially remote/work from home arrangements.

From a financial risk perspective, liquidity risk management came to the forefront for a number of trustees. Investment markets reacted swiftly to COVID-19, leading to a significant downturn in equity markets and an increase in volatility. The fall in listed equity markets led to a short-term fall in investment returns across the superannuation industry, with APRA-regulated funds experiencing a rate of return of –10.3 per cent in aggregate for the March 2020 quarter – a drop in investment returns not seen since the height of the GFC.

In addition, the decline in the Australian dollar increased the need for trustees to make cash available to meet settlement obligations within their currency hedging programs, at the same time as a large number of members switched to cash or other lower risk investment options. Liquidity in fixed interest markets also deteriorated – as indicated by a lack of market depth in both credit and government bond markets and a significant widening in bond spreads.

The sharp rise in bond yields in mid-March, as equities were still falling, indicated a widespread move to cash by a range of investment market participants, including both members and investment managers. The percentage of superannuation assets held in cash increased from 10 per cent at the close of 2019 to 14 per cent during the March quarter.

The Early Release Scheme

Recognising the worsening economic environment, the Australian Government implemented a number of measures to help people experiencing hardship and income loss as a result of COVID-19. This included significantly expanding the eligibility criteria for early release of superannuation in April 2020, known as the Early Release Scheme (ERS).

Implementation of the ERS required timely and accurate processing of applications by trustees, and was generally well-managed by the superannuation industry. However, the prevailing market volatility and initial uncertainty surrounding the likely number and value of ERS applications, together with increased member switching and other cash needs, made it difficult for some trustees to accurately estimate short-term cash requirements.

This led to some trustees holding cash allocations significantly above their target levels, and also movement in the actual asset allocation for other asset classes. These shifts in the weighting of actual asset allocations away from target allocation will need to be corrected over the near to medium term.

However, initial concerns about trustees’ ability to manage liquidity challenges associated with the ERS around the time of its introduction abated reasonably quickly. Indeed, the trustees of APRA-regulated funds have, on the whole, handled the heightened liquidity pressures reasonably well, with all funds able to meet liquidity needs to date.

This outcome strongly reflects the improvements made by trustees since the GFC, particularly improvements in liquidity risk management practices to address the enhanced requirements of APRA’s Prudential Standard SPS 530 Investment Governance (SPS 530), which was introduced in 2013. These changes enabled trustees to have a better understanding of their drivers of liquidity risk, and a planned approach to improve liquidity in circumstances where liquidity demands were significantly increased.

Key factors impacting fund liquidity during COVID-19 (February - June 2020):

APRA’s response

Due to the increase in liquidity pressure facing the superannuation industry through COVID-19, APRA has been working with trustees to ensure their liquidity management continues to be robust and effective. Initially, APRA engaged with trustees that expected significant ERS payments, collected more detailed data on the liquidity profile of their investment options, and began weekly monitoring of ERS payments to enable a timely response to any identified concerns.

These actions allowed APRA to target its supervisory activities to ensure trustees were appropriately managing liquidity pressures, and that appropriate outcomes continued to be delivered to members. However, APRA’s supervision activity over this period has also highlighted some areas where trustees should consider further improvement to their liquidity management practices.

The road ahead

The past few months have demonstrated the potential challenges of maintaining actual asset allocations that are consistent with the strategic asset allocations in trustees’ investment strategy during times of heightened liquidity requirements. COVID-19 has also highlighted the importance of trustees maintaining up-to-date and comprehensive Liquidity Management Plans.

To ensure those responsible for managing Australians’ retirement savings refocus their attention on the importance of liquidity risk management, trustees will need to place particular emphasis on:

- Reviewing their Liquidity Management Plan and liquidity stress testing practices to take into account new information, and to ensure the underlying assumptions remain appropriate, particularly if the maintenance of the strategic asset allocations in their investment strategies proves challenging.

- Ensuring their Liquidity Management Plan includes clearly defined ‘liquidity events’ such as investment option switching (member-generated events) or capital drawdowns arising from specific investments (investment/asset-specific events), and that these events or triggers are regularly reviewed to take into account changes in the environment or actual experience.

- Ensuring their liquidity stress testing considers the likelihood that the underlying drivers of liquidity risk such as significant market turndowns, member switching and increased redemption requests may occur simultaneously under certain extreme scenarios. Assumptions should be regularly updated to reflect the fact that certain assets become less liquid under stressed market conditions.

- Embedding the results of liquidity stress testing into the formulation and review of investment strategies, taking into account recent and future liquidity requirements and the impact on actual versus strategic asset allocation.

- Where liquidity stress testing is outsourced to a third party (such as an asset consultant), ensuring the necessary arrangements are in place to enable stress testing to be adequately updated to reflect rapidly changing environments, and the outcomes from stress testing are made available in a timely manner.

The rebound in both equity markets and the Australian dollar in recent months, together with the decline in member switching activity, have combined to reduce short-term liquidity pressures for superannuation funds. Nevertheless, the economic environment remains uncertain and this is expected to continue for the foreseeable future. APRA will therefore continue to monitor how trustees are managing factors that may impact fund liquidity, to ensure appropriate outcomes continue to be delivered for Australia’s millions of superannuation fund members.

Return to APRA Insight - Issue 3 2020

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.