A message from APRA Deputy Chair Helen Rowell

APRA has now published its much anticipated MySuper Heatmap, ushering in a new era of transparency and accountability for superannuation trustees. Using a graduating colour scheme, it publicly reveals APRA’s assessment of every MySuper product in two areas: investment performance, and fees and costs; and insights into the sustainability of member outcomes.

The heatmap represents a major step in APRA’s efforts to enhance member outcomes by raising industry standards and weeding out underperforming funds. It has been chiefly designed to put added pressure on the trustees of underperforming funds to make urgent improvements, or consider exiting the industry. Secondly, it delivers – for the first time – clear, simple insights into the outcomes being delivered to members in an industry where such comparisons have long been notoriously challenging to make. Those insights can be used by members, employers and other stakeholders to make better informed superannuation decisions. In that sense, the heatmap is designed with the ultimate interests of members very much in mind.

Since publishing an information paper in November detailing the metrics and methodology behind the heatmap, APRA has been engaging intensively with superannuation trustees, industry bodies and other key stakeholders. In addition to conducting multiple webinars, we wrote directly to the trustees responsible for the MySuper products that the heatmap has shown as the poorest performers and followed up with face-to-face meetings to explain why their products have been identified as poor performers, and discuss the actions needed to address those weaknesses. We will continue to engage closely with these trustees, and should their performance not substantially lift in a timeframe acceptable to APRA, we will be urging them to seriously consider their future in the industry.

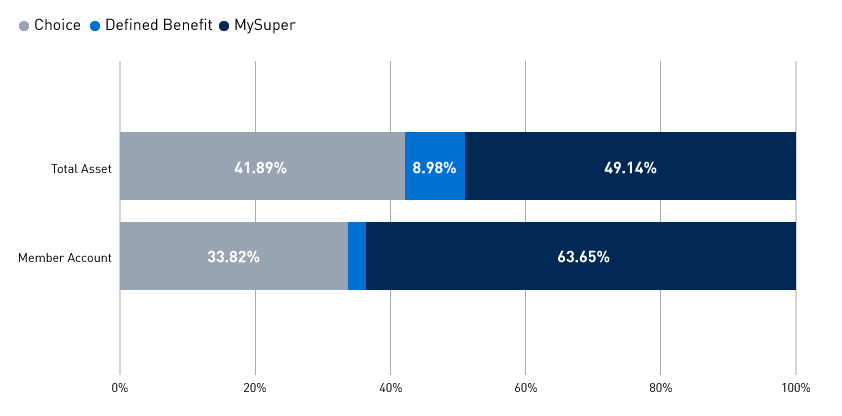

For the time being, the heatmap only covers MySuper products, but the significance of that market segment shouldn’t be dismissed. As the graph below shows, MySuper products represent the largest segment of the market, both in terms of assets and number of member accounts. However, APRA also recognises the importance of expanding the heatmap to include choice products, which brings me to APRA’s second recent major superannuation announcement.

On 7 November, APRA launched its Superannuation Data Transformation, a multi-year project to upgrade the breadth, depth and quality of its superannuation data collection. The first phase is now underway, with a focus on addressing the most urgent gaps in APRA’s data collection, particularly for choice products and investment options. Phases 2 and 3 will increase the granularity and consistency of the entire superannuation data collection.

As part of this project, two topic papers covering Performance and Member Accounts will be released this week, and a third topic paper on RSE Structure and Profile is currently in consultation.

Although separate projects, both the heatmap and the Super Data Transformation are closely linked and strongly aligned in their objectives. Not only will data on choice products feed into an expanded heatmap, both initiatives are intended to enhance industry transparency and accountability. In doing so, they will help APRA achieve the key strategic priority articulated in its recently updated Corporate Plan – improving member outcomes in superannuation.

Helen Rowell

APRA Deputy Chair

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.