Temporary loan repayment deferrals due to COVID-19, October 2021

As announced on 19 July 2021, APRA provided a further round of temporary regulatory treatment for loans impacted by COVID-19. For eligible borrowers, ADIs do not need to treat a repayment deferral as a loan restructuring or the period of deferral as a period of arrears.

To provide greater transparency APRA is resuming publishing of aggregate and entity-level loan repayment deferrals data, in a similar manner as in 2020/21. In this ‘second round’, however, the threshold for reporting has been lifted to those ADIs with $50 million and 50 facilities in loans subject to repayment deferral, compared to $20 million and 20 facilities in the ‘first round’.

A number of ADIs have chosen to take advantage of this capital treatment and allow borrowers to defer their loan repayments for a period of time. Other ADIs have chosen to support their customers through various other means, including offering repayment deferrals without taking advantage of the concessional capital treatment. While these ADIs may not appear in the published statistics as they do not meet the threshold for reporting, this does not suggest they are not providing appropriate support for their customers.

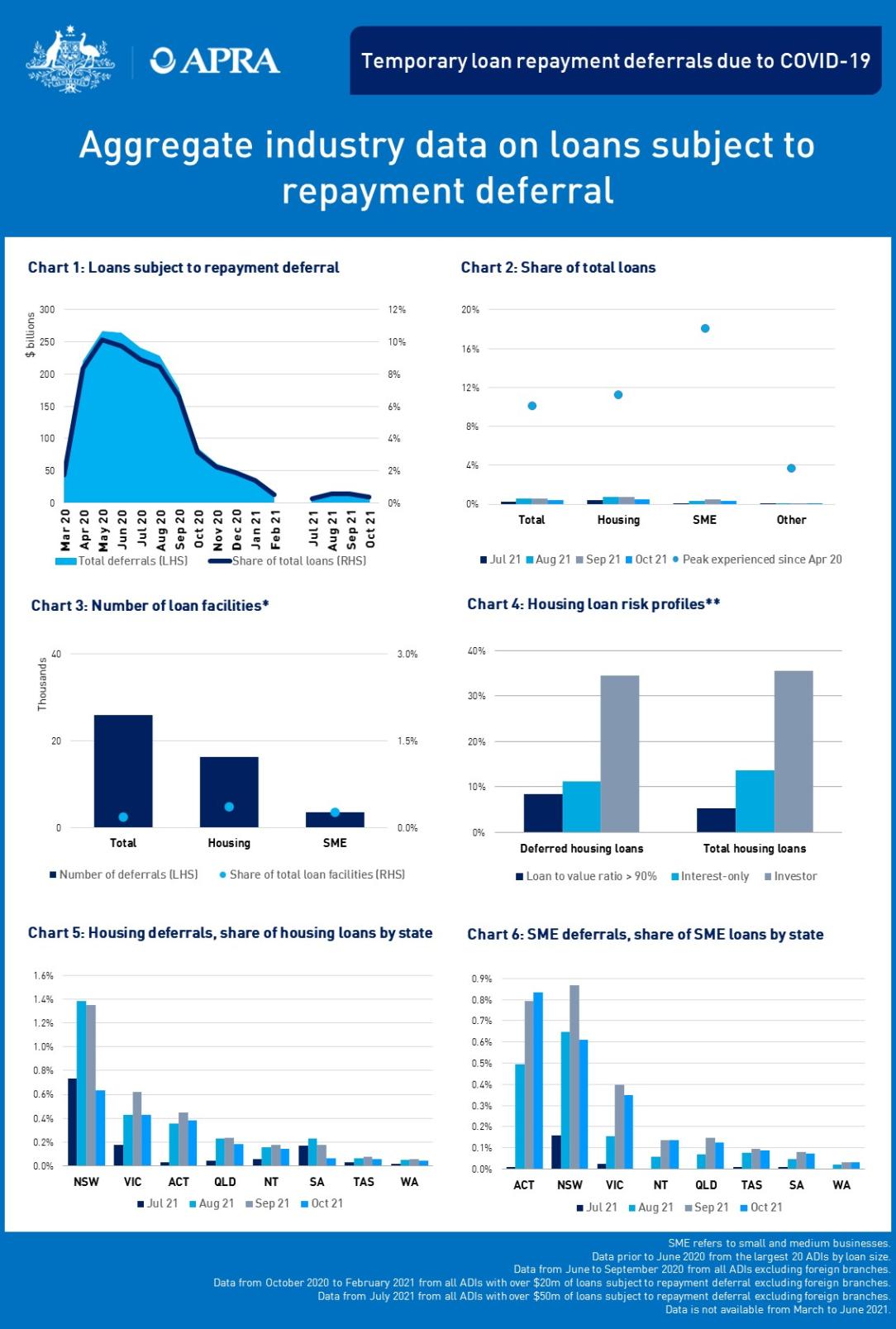

* the number of facilities does not necessarily indicate the number of borrowers as individual facilities with more than one repayment type may be reported more than once.

** to give an indicator of potential elevated risk in loans subject to deferral this chart compares loans subject to deferral to total loans across three key cohorts – loan to value ratio of greater than 90 per cent, investor loans and interest only loans.

An accessible version of this dashboard is available here.

Additional commentary

| Deferred loans | Total loans1 | Deferred loans, share of total loans |

Total | $8.5 billion | $2.2 trillion | 0.4% |

Housing | $7.2 billion | $1.5 trillion | 0.5% |

SME | $0.9 billion | $254.2 billion | 0.4% |

As at 31 October, according to data submitted by ADIs with over $50 million in loans subject to repayment deferral, a total of $8.5 billion worth of loans are on temporary repayment deferrals, which is around 0.4 per cent of total loans outstanding for these ADIs, down from $13.1 billion (0.6 per cent of total loans outstanding) in September. This remains at a significantly lower amount than at the height of the crisis in mid-2020 where repayment deferrals peaked at around 10 per cent of total lending.

Housing loans represented the majority (85 per cent) of loans subject to repayment deferral at $7.2 billion (0.5 per cent of total housing loans) as at the end of October. Small and medium enterprise (SME) loans subject to repayment deferral were low at $926 million (0.4 per cent of total SME loans).

Across the states and territories, NSW continues to have the highest share of housing loans subject to deferral though this share fell significantly from 1.4 per cent in September to 0.6 per cent in October.

Explanatory notes

This data is sourced from the domestic loan portfolios2 of APRA-regulated authorised deposit-taking institutions (ADIs), excluding foreign branches. The spreadsheet below contains data for all ADIs with total loans subject to temporary repayment deferral of greater than $50 million and more than 50 deferred facilities in any given reporting period. In addition, for privacy reasons, fields are masked where there is a non-zero value below $10 million or there are less than 20 facilities. For an entity where either the "new or extended in the month" field or the "expired or exited in the month" field falls below this threshold, both of these fields are masked.

Changes in total loans subject temporary repayment deferral occur due to several factors. These factors include (but are not limited to) new deferrals, exits from deferral, addition of interest charges on existing deferrals and customers paying down their loans subject to deferral. Also note that, when a borrower’s loan repayment deferral is extended it is reported in this data as both "expired or exited in the month" (as the initial deferral has expired) and "new or extended in the month" (as it has been extended).

All data has been submitted to APRA on a best endeavours basis under relatively tight timeframes. As a result, data may be revised in future reports.

Footnote

1 Of ADIs that meet the reporting threshold for loan repayment deferrals.

2 Domestic loan portfolio refers to loans provided within Australia on the balance sheet of the licenced ADI.

Next issue

The concessional treatment for new loans subject to repayment deferral ended on 30 September 2021. APRA is therefore discontinuing this statistical publication, with this October edition being the final publication of this data. Information on the ongoing performance of ADI lending, including non-performing loans, will be available in future editions of APRA’s regular quarterly statistical publications available on the APRA website at: Quarterly authorised deposit-taking institution statistics.

For more information

Email dataanalytics@apra.gov.au or mail to

Manager, External Data Reporting

Australian Prudential Regulation Authority

GPO Box 9836, Sydney NSW 2001Looking for discontinued publications?

Search historical snapshots of APRA's website on the Australian Government web archive.