Implementation of the retirement income covenant

The retirement income covenant (the covenant), which takes effect from 1 July 2022, has been introduced to the Superannuation Industry Supervision Act 1993 (SIS Act).1 RSE licensees are required to formulate a retirement income strategy (the strategy) and publish a summary of the strategy on the superannuation entity’s website by 1 July 2022. The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) expect implementation of the strategy to be subject to a continuous improvement process from 1 July 2022 onwards.

These legislative amendments are an important step in broadening industry focus beyond the accumulation phase to advance the decumulation, or retirement, phase of superannuation, and in encouraging RSE licensees to innovate to improve outcomes for their members in retirement.

This letter outlines an indicative implementation pathway for RSE licensees to consider when embedding the covenant into their business operations, and communicates APRA’s and ASIC’s expectations of RSE licensees in implementing the covenant.

Indicative implementation pathway

The Explanatory Memorandum to the amending legislation explains the intent of the reforms, including that member outcomes in retirement will improve when RSE licensees are encouraged to focus on retirement outcomes and implement retirement income strategies.2

Given the intention to allow RSE licensees flexibility in implementing the retirement income covenant, APRA and ASIC do not intend to issue detailed regulatory guidance on how RSE licensees should implement the covenant. Instead, time will be allowed for RSE licensees to drive the strategic direction of their retirement income strategies and to innovate on the implementation of the covenant for their membership.

APRA and ASIC expect that RSE licensees will continue to assess, develop and improve their retirement income strategy, and that RSE licensees will implement their strategies effectively in the best financial interests of beneficiaries and consistently with other regulatory obligations. This expectation is consistent with the continuous improvement emphasis in Prudential Standard SPS 515 Strategic Planning and Member Outcomes (SPS 515) and the need to take a member-centric approach in monitoring and reviewing outcomes as part of the product design and distribution obligations (DDOs).3

There are a number of steps that a prudent RSE licensee would plan to complete over the short, medium and longer term to demonstrate their implementation of their strategies (refer to Figure 1 below). RSE licensees should seek to align these steps with their existing business planning and other review cycles where practical.

Of particular importance is how RSE licensees will adjust their retirement income strategy over time, as they gather new and more detailed information about their memberships and draw on the insights gleaned from reviewing their strategy. For example, an RSE licensee might decide to provide some forms of assistance to its members in the initial phases of its retirement income strategy, and change or expand these forms over time as it gathers evidence about how the assistance is being used by members.

Figure 1: Indicative implementation pathway 2022-2025

By 1 July 2022 |

|

From 1 July 2022 |

|

2022–2023 (and annually) |

|

By 30 June 2025 |

|

Embedding retirement income considerations into existing practices

APRA and ASIC acknowledge that many RSE licensees will have a strong understanding of their members’ needs already and may have already operated in the retirement income market for some time, within the context of existing regulatory obligations and guidance.

As such, embedding retirement income strategies within existing business practices and frameworks is likely to be an efficient way for RSE licensees to:

- enhance retirement outcomes for members;

- demonstrate compliance with the new obligations; and

- further build on their understanding of their members who are approaching, or are in, the retirement phase.

RSE licensees can do this by embedding their retirement income strategies in existing business planning and governance frameworks, risk management practices and controls, as well as by assessing the adequacy of resources to support the retirement phase. There may also be opportunities for RSE licensees to use their retirement income strategy to assist meeting other obligations, including the DDOs.

The covenant does not specifically require RSE licensees to develop or offer retirement income products. However, APRA and ASIC expect RSE licensees will consider whether to make changes to any existing retirement income product offerings, including whether to offer products external to the RSE licensee’s own products, in the context of their specific circumstances. As set out in the Explanatory Memorandum, a retirement income strategy may also include providing a range of assistance to members, such as developing specific drawdown patterns, providing budgeting tools or expenditure calculators, providing factual information about key retirement topics, and providing forecasts to beneficiaries during the accumulation phase about potential income in retirement.

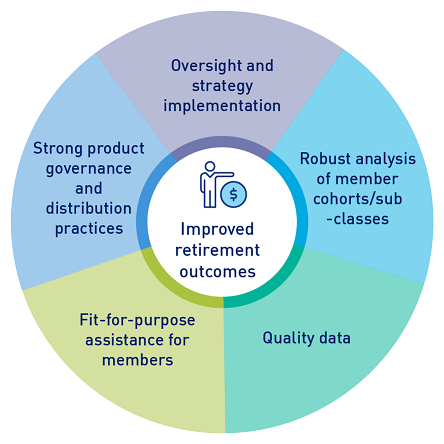

In order to develop an effective retirement income strategy to assist members in retirement, a prudent RSE licensee would consider the areas outlined in Attachment A which, in part, draw on existing practices and obligations.

Figure 2: Key areas for RSE licensee consideration

Consultation on prudential framework amendments

Later in 2022, APRA plans to commence consultation to examine how the covenant could be integrated into the superannuation prudential framework. This consultation will be informed by RSE licensees’ experience in implementing the covenant.

The consultation will cover potential amendments that would put into effect the guidance in the Explanatory Memorandum, including the expectation that reviews would take place in a similar manner to those for the investment covenant (where reviews of the outcomes from the strategy are annual, and reviews of the strategy itself occur every three years).

APRA will also consider whether and how to adjust the prudential framework more generally to ensure there is a clear connection between the retirement income covenant and existing prudential requirements relating to member outcomes, which are currently set out in SPS 515 and related guidance.

Please contact your APRA responsible supervisor or ASIC contact if you wish to discuss any matter raised in this letter.

Margaret Cole Member | Danielle Press Commissioner |

Attachment A: Implementation of the retirement income covenant – Key considerations

The tables below set out some considerations that a prudent RSE licensee would consider in order to develop an effective retirement income strategy to assist members in or approaching retirement.

- Develop the retirement income strategy consistently with the RSE licensee’s next business plan, reflecting ongoing strategic objectives and desired member outcomes.

- Align the first annual review of the outcomes from the retirement income strategy (to be completed by June 2023) with the RSE licensee’s next business performance review, consistently with the RSE licensee’s existing approach under SPS 515.

- Develop the process for how determinations and decisions will be recorded, including the level of detail to be captured to inform the summary of the retirement income strategy that is required to be published under the covenant.

- Determine how the period of retirement will be defined with reference to the membership.

- Determine how the class of beneficiaries who are retired or who are approaching retirement will be defined.

- Decide how to define, and to help members to manage, specific risks (e.g. longevity risks, investment risks, inflation risks, and any other risks to the sustainability and stability of retirement income).

- Use insights from the RSE licensee’s business performance reviews and reviews of target market determinations to inform the review and refinement of the retirement income strategy.4

- Use information gathered about the needs of members in or approaching retirement in developing the retirement income strategy to assess whether relevant target market determinations remain appropriate.5

- Assess the appropriateness of reasonable steps taken to ensure that distribution of retirement income products is consistent with relevant target market determinations.6

- Implement controls to ensure that retirement income products are not offered contrary to the hawking prohibition.7 For example, RSE licensees could consider providing information about available products without making a real-time offer or invitation to apply, by making any offers or invitations through other channels (e.g. written communications), or by seeking member consent to receive offers or invitations in real time.

If considering the development of new innovative retirement income products, engage with the Cross-Agency Process for Innovative Retirement Income Products.8

- Consider whether, and how, to develop sub-classes of members for the purposes of the retirement income strategy by reviewing current approaches to undertaking cohort analysis for the purposes of the business performance review (as required by SPS 515) and the annual outcomes assessment under the SIS Act.

- Identify sources and availability of necessary data about the membership to inform the retirement income strategy, both at the outset and on an ongoing basis.

- Plan how to gather evidence about how an RSE licensee’s members are using assistance provided by the RSE licensee to support the ongoing improvement of the assistance provided as part of the retirement income strategy.

- Draw on available consumer and behavioural research about how members are likely to engage and interact with the way assistance is provided.

- Consider providing factual information to members about retirement income, for example, information about eligibility for the Age Pension or aged care, the concept of drawing down capital as a form of income, or the different types of income streams available.9

- Consider making available budgeting tools or expenditure calculators that do not relate to specific financial products.

- Consider providing forecasts, such as superannuation calculators or retirement estimates, to help some members think about how superannuation can be part of their retirement income.10

- Consider drawing on or linking to content on the Moneysmart website, which contains information and calculators (including a retirement planner tool) to help consumers make informed financial decisions about their superannuation and retirement.11

- Consider whether and how to offer financial product advice (either general advice or personal advice) to members.12

- Where an RSE licensee is not licensed to provide general or personal advice, or would be unable to comply with the obligations for giving advice, consider alternatives such as referring members to externally provided financial advice services (i.e. provided by a different entity), and ensuring adequate controls are in place to oversee the deductions from a member’s superannuation account to pay for such advice.13

- Consider how the different types of assistance offered to members form a ‘choice architecture’ that influences member decisions and outcomes.

Footnotes

1Refer to Schedule 9, Corporate Collective Investment Vehicle Framework and Other Measures Act 2022 (Cth) (amending legislation).

2Refer to chapter 17 of the Explanatory Memorandum: Corporate Collective Investment Vehicle Framework and Other Measures Bill 2021 – Parliament of Australia (aph.gov.au)

3Both SPS 515 and the DDOs already require RSE licensees to make evidence-based decisions based on the outcomes they are seeking to achieve for their members, and to monitor and review their product offerings and operations on an ongoing basis. Refer to APRA and ASIC’s joint letter to RSE licensees – December 2020: Member Outcomes and Design and Distribution Obligations | APRA

4Refer to APRA and ASIC’s joint letter to RSE licensees – December 2020: Member Outcomes and Design and Distribution Obligations | APRA

5Refer to part 7.8A of the Corporations Act 2001 and ASIC’s Regulatory Guide 274 Product Design and Distribution Obligations (Regulatory Guide 274)

6Refer to Regulatory Guide 274.

7Refer to ASIC’s Regulatory Guide 38 The hawking prohibition.

8Further information of the Cross-Agency Process for Innovative Retirement Income Products is available here: Cross-agency process for retirement income stream products | APRA.

9Refer to ASIC’s Regulatory Guide 244 Giving information, general advice and scaled advice and Regulatory Guide 234 Advertising financial products and services (including credit): Good practice guidance.

10ASIC currently provides relief from certain obligations relating to personal advice for trustees who provide superannuation calculators or retirement estimates (and for other entities who provide superannuation calculators). This relief is currently under review. Refer to ASIC’s Regulatory Guide 229 Superannuation forecasts, Regulatory Guide 167 Licensing: Discretionary powers and Consultation Paper 351 Superannuation forecasts: Update to relief and guidance.

12Refer to ASIC’s Regulatory Guide 36 Licensing: Financial product advice and dealing, Regulatory Guide 244 Giving information, general advice and scaled advice and Regulatory Guide 175Licensing: Financial product advisers—Conduct and disclosure.

13Refer to ASIC’s Information Sheet 168 Giving and collectively charging for intra-fund advice and Information Sheet 256 FAQs: Ongoing fee arrangements. See also Further guidance on oversight of advice fees charged to members’ superannuation accounts (30 June 2021) and ASIC and APRA letter to trustees on oversight of advice fee deductions from member accounts (10 April 2019).