Deputy Chair John Lonsdale - speech to Customer Owned Banking Association (COBA) 2021 CEO & Directors Forum

Mutual banking: challenges and change

Thank you for the opportunity to be with you today.

Since I last spoke at a COBA event in early December, Australia has continued to be in a fortunate position relative to many other countries. With low COVID-19 cases, we have seen a number of strong indicators of economic recovery and the stability of the financial system has remained sound.

Banks and other authorised deposit-taking institutions (ADIs) have had a crucial role supporting this recovery, with the mutual sector playing its part and maintaining the capacity to support customers. But challenges remain to ensure that smaller ADIs remain sustainable and continue to serve their customers into the future. We are not out of the woods yet, and the outlook remains uncertain.

Today I’d like to examine how mutual banks are performing relative to the wider industry, discuss some of the key risks – particularly cyber-attack risk – and touch on how APRA is mitigating regulatory burden by taking a proportionate approach wherever possible.

First however, I will address an issue that has been garnering a few column inches in the media of late – that of housing. The current environment is characterised by record low interest rates, rising house prices and high household indebtedness.

Given that the predominate business of Australia’s banking system is mortgage lending, our focus is on ensuring that ADIs manage risks to their balance sheets in this environment. Loan portfolios of mutuals are heavily weighted towards housing, and COBA members need to be particularly attuned to shifts in their risk composition.

APRA’s expectation is that ADIs should be careful about relaxing risk appetite limits and lending standards at this time.

In aggregate, we are not seeing a return to higher risk lending, particularly in areas where we have intervened in the past such as investor and interest-only loans. However, it is important that standards are maintained, monitored and tested. Recently we wrote to the 14 largest ADIs requesting more detailed data on their lending portfolios, and seeking assurances from Boards regarding lending standards.

All Boards should be closely monitoring their lending standards, comfortable with their risk appetite and testing whether serviceability policies used to assess borrowers remain prudent in an environment of extremely low interest rates.

To minimise regulatory burden, the majority of COBA members have not been sent this letter and data request. Nonetheless, smaller ADIs are also expected to be rigorous in monitoring and testing their own risk appetite and lending standards, rather than waiting for a call from their APRA supervisor.

The competition impact of regulation and lending benchmarks will always be an important consideration for APRA. We have been mindful of impacting the competitive landscape when we have intervened in the past, but also sought to ensure that raising standards in one part of the industry is not resulting in weaker credit drifting to other parts. As we monitor conditions, test standards and reflect on what we are seeing, APRA will continue to hold competition as a key consideration.

The objective here is to maintain a healthy, resilient and diverse industry that can serve the needs of a diverse Australian community in a sustainable manner.

Mutual benefits that sustain

Turning to the mutual sector specifically, APRA recognises the close connection between mutuals and the communities they serve. There is a challenge here for the sector however, to keep adapting so that it remains relevant and resilient.

As the financial services safety regulator, stability and resilience are central to our objectives. It has been pleasing to see that, to date, our financial services industry has demonstrated sound operational resilience despite the imposition of lockdowns and other challenges. For mutuals, that generally have a greater reliance on their branches, this was not an easy task.

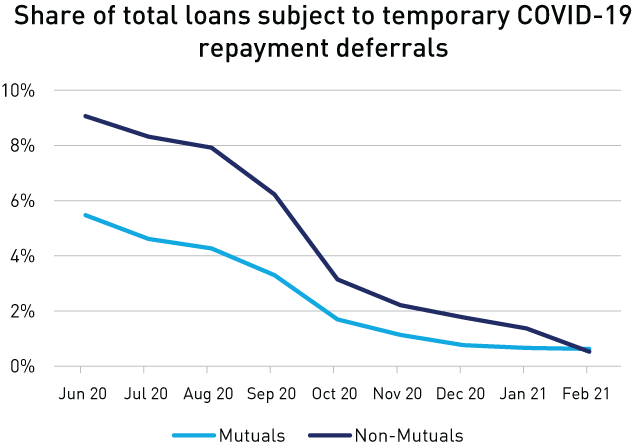

Importantly, our banking system provided a much-needed cushion for customers and the economy. The granting of loan repayment deferrals served to bridge the gap between the difficult short-term circumstances faced by some customers and their long-term financial health. Mutuals have a good story to tell about their contribution. I will examine this and broader aspects of their performance through a number of charts.

Chart 1 compares mutual banks to the rest of industry and shows that a smaller proportion of loans written by mutuals were impacted by repayment deferrals due to COVID-19. Mutuals maintained this position relative to the wider industry as they worked with customers to recommence payments. This suggests mutuals have been able to offer high quality loans to their customers at the outset, and to manage through a crisis in a way that supports their customers.

It’s worth repeating that the support our banking system provided to customers through loan deferrals was possible due to the strength that had been established over a number of years – particularly the capital position and the health of loan portfolios. Mutuals have maintained strong capital and CET1 ratios, and have so far weathered the impacts of COVID-19 well.

This reflects well on smaller ADIs, but does not tell the full story when it comes to ongoing sustainability. At the risk of overwhelming you with charts, if we delve a bit further into the data comparing mutuals to the majors, their relative performance provides some indication of how the sector is tracking and the challenges ahead.

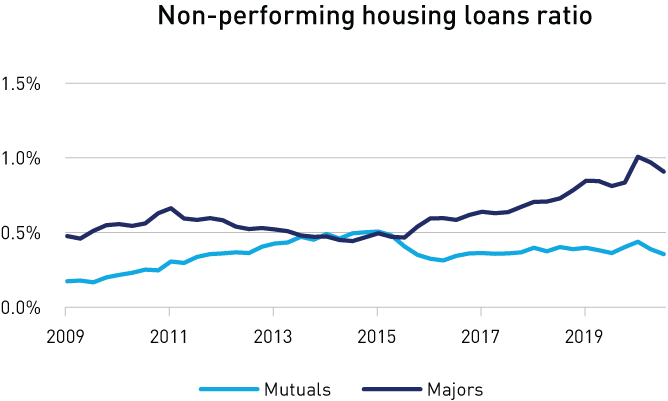

Chart 2 shows the ratio of non-performing housing loans and reveals the strong performance of mutuals over the past decade. The ratio has remained relatively steady at around 0.4 per cent over recent years. At December of last year, it was less than half that of the majors – 0.4 per cent compared to 0.9 per cent.

It’s fair to say this differential is a reflection of the depth of understanding that mutuals have of their customers, and their ability to adhere to sound lending practices. That said, it’s worth noting that 14 mutuals have non-performing housing loan ratios of over 0.6 per cent, which is 50 per cent higher than the average for the sector – so performance does vary.

While non-performing loans have remained relatively steady, when it comes to consolidation, there has been a remarkable degree of change in the industry over the past decade. The number of mutual ADIs almost halved between 2010 and 2020, from 116 to 64. This consolidation is expected to continue and indeed, a number of mergers are currently underway.

Despite a large reduction in the number of mutuals, market share has risen over the decade to 2020 – albeit to a modest proportion in absolute terms. Market share of total assets increased from 2.2 to 2.7 per cent, and of housing loans increased from 4.2 to 4.7 per cent.

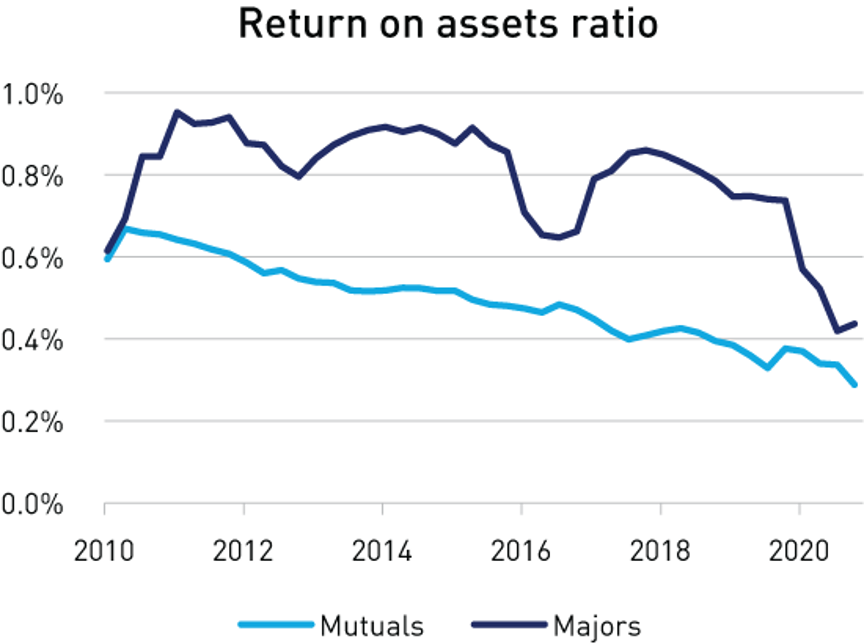

While these are positives for the mutual sector, there are also challenges. If we track the return on assets ratio over the past decade (chart 3), there has been a marked, if fluctuating, gap between mutuals and the majors. It’s also clear that the ratio for mutuals has shown a steady decline.

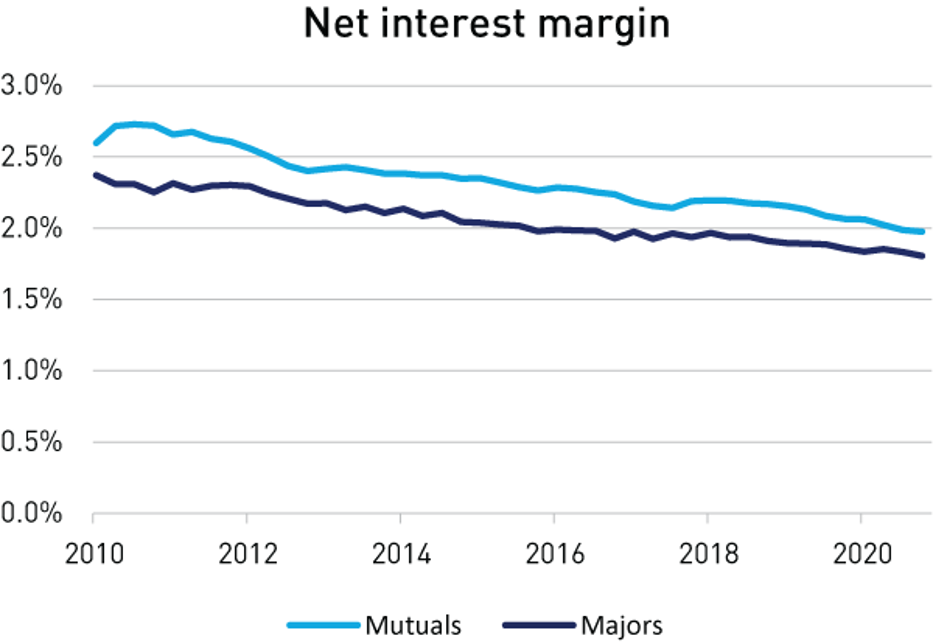

It’s a similar trajectory for net interest margin (chart 4) which, in this low interest rate environment, has continued to decrease. And while the trajectory of mutuals and the majors have been running in parallel, economies of scale provide the larger banks with an advantage when facing into this headwind.

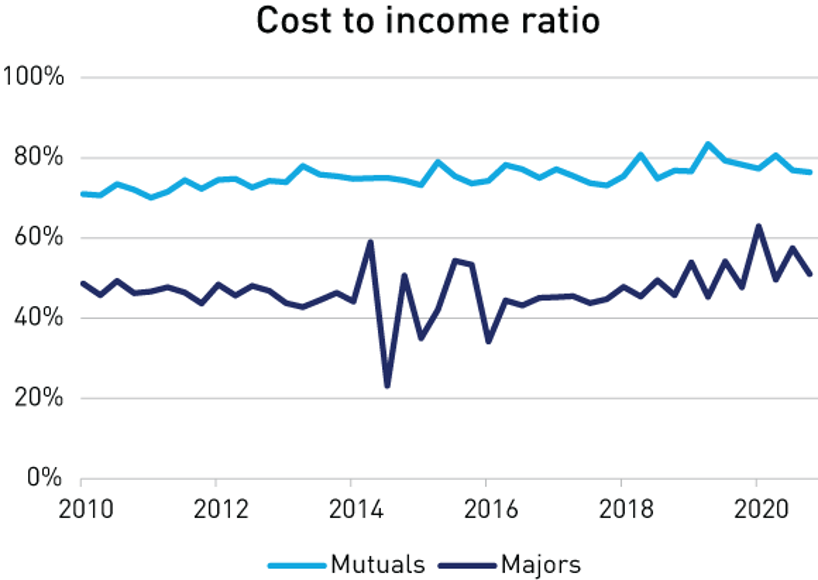

As NIMs decline, there is a greater need to focus on cost pressures to remain profitable. Looking at the cost to income ratio (chart 5) over the past decade, it’s clear that the gap between the mutual sector and the major banks has remained, with this ratio increasing a few percentage points over the past decade for mutuals. I would note that there are some outliers - 16 mutuals have a cost to income ratio of over 90 per cent.

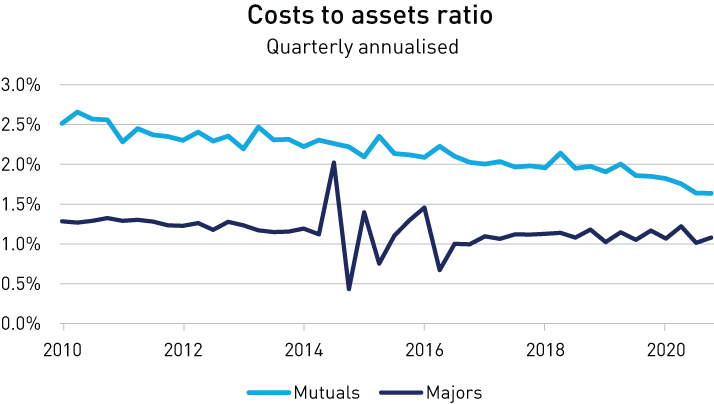

While the reduction in the number of mutual ADIs has not affected the cost to income ratio of the sector, the story is different for the cost to assets ratio (chart 6). There has been a significant reduction in the cost to assets ratio, and the fall is even more pronounced if we look back into the previous decade. This suggests that the sector is heading in the right direction and executing the changes necessary to maintain sustainability.

Looking forward, challenges to profitably, and in turn sustainability, will remain and likely grow. As a regulator that values the mutual sector and the role it plays, I encourage you to continue exploring every opportunity to confront and solve these challenges.

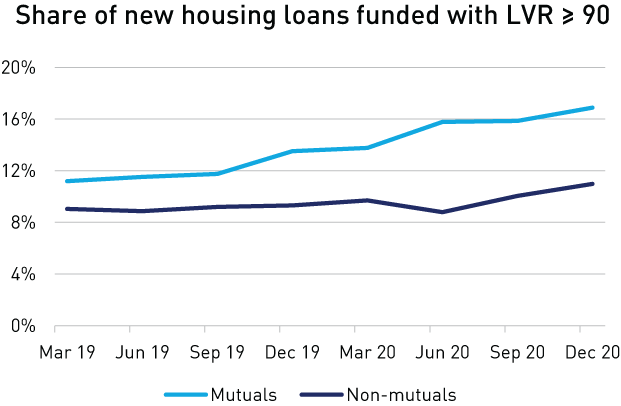

I have one final chart. As you might expect from a prudential regulator, I will finish by highlighting a potential risk. This shows recent changes in the proportion of new housing loans with a loan-to-valuation ratio of greater than or equal to 90 per cent (chart 7).

For the mutual sector, it rose from 11 per cent in March 2019 to 17 per cent in December 2020. This is a notable increase. While LVR is only one of a number of metrics that need to be considered, it does raise the question of whether the mutual sector is taking on more risk in pursuit of market share, and how sustainable that is.

As I mentioned at the outset, it’s critical in the current environment of heightened risk that Boards remain highly attuned to shifts in the composition of their lending book. APRA is aware of the cost pressures faced by the sector and is doing what it can to reduce regulatory burden for mutuals. This will continue to be a focus.

However, managing costs does not depend only on adjustments to regulatory requirements. It is the responsibility of Boards to formulate a strategy that enables their business to sustain into the future.

This means close monitoring of risk, making investments that are manageable and provide an adequate return, and a realistic assessment of the prospect of ongoing profitability. This may require members of COBA to work more closely together, including considering the possibility of mergers where that makes sense.

Perhaps of most importance is ensuring that your customers continue to value what you’re offering. As specialised players in a highly commoditised market with large, well-resourced competitors, having the unique business model that mutuals offer and providing a distinctive customer experience are key to remaining relevant to your community of customers. This is something that no regulator is able to influence – it remains the responsibility of Boards and management.

This is indeed a challenge in the face of pressures to respond to changing customer demands, including for enhanced digital services and cyber security.

Demanding digital

As you know, improving cyber resilience across the financial system is a key community outcome for APRA. Since the beginning of COVID-19, cyber risks have escalated. We are also aware that there are areas where the industry is falling short when it comes to implementing comprehensive practices to prevent, detect and respond to cyber threats.

What we’re observing are issues such as inadequate patching, out-of-support systems and poor user-access management practices, as well as cyber response plans that are limited in coverage or untested. The risk is that an entity has unnecessary cyber exposures and will not be sufficiently ‘battle ready’ to respond decisively if an incident occurs. The risks are compounded by limitations in business continuity capability, bringing into question an entity’s ability to continue operating after a cyber-attack.

Following the introduction of the new standard on information security, CPS 234, APRA intends to update Prudential Standard CPS 232 Business Continuity to drive change in industry practice, including the maintenance and regular testing of back-up data.

We have also commenced the process of requiring entities to have independent cyber security reviews. A pilot with nine entities undertaking reviews is underway, including some COBA members, with results expected in the coming months. While early discussions have occurred with pilot entities and audit firms to ensure quality outcomes, it is too early for any themes to have emerged.

However, supervisory activities to date and the sizeable volume of entities that requested COVID-19 relief extensions for compliance with our information security standard, CPS 234, suggest there is much work to do in uplifting entities’ information security posture.

Malicious actors will always seek out the weakest link, which may exist in an external service provider. APRA does have concerns that some entities are not adequately interrogating key suppliers when it comes to assessing cyber controls. It’s an area that we intend to strengthen with changes to the outsourcing standard, CPS 231.

Entities are placing a great deal of trust in their providers, so it is important not only to trust but also to verify. Ultimately, if something goes wrong, it’s important to remember your customers will hold you, and not your supplier, accountable.

As the media headlines remind us, mismanagement of reputational risk can have catastrophic consequences for business. Trust in a brand can take decades to build and hours to destroy. With heightened community awareness of the importance of information security, loyal and prospective customers may well think twice before trusting their finances to an entity that has proved to be susceptible to cyber-attack.

Mutuals have a history of being able to combine resources effectively to maximise return on investment, and I’m aware that this approach is being adopted to good effect by much of the mutual sector with regard to digital platforms. But not all entities are taking this course of action, and there is a risk that some are not adequately prepared.

APRA’s expectation, as detailed in our Cyber Security Strategy released last November, is that Boards are focused on the risk of cyber-attacks and taking the necessary steps to address their exposure. Fortunately, we have not had any APRA-regulated entities crippled by a successful cyber-attack, but it is reasonable to expect that it is just a matter of time.

More in proportion is less

Having the resources necessary to invest in mitigating a broad range of risks requires that mutuals remain competitive and profitable, which brings me to the issue of competition and the proportional application of regulatory requirements.

One of APRA’s objectives is to have a regulatory framework and supervisory practices that maintain stability within the banking industry, delivered in a manner that is as efficient as possible. We remain cognizant of the need for our framework to be designed in a way that accounts for the various characteristics of Australia’s ADIs, and maintains competitive neutrality.

We speak to COBA members regularly and know that you worry a lot about regulatory burden. We are aware of the potential for APRA’s regulatory requirements to impact smaller entities disproportionately, and make every effort to ensure mutuals are not being unduly disadvantaged relative to their larger competitors. I would make the point that while you feel the full impact of what we do require, what may be less obvious are the requirements that apply to others that APRA decided were not essential for smaller ADIs.

Consideration of how changes to APRA’s regulatory framework will impact smaller entities is now baked into our policy development process. You saw evidence of this in the consultation for revisions to the ADI capital framework that was released in December last year.

The simplified framework for smaller ADIs is designed to deliver a material reduction in regulatory burden. In this consultation we have proposed increasing the threshold for an ADI to be able to operate on the simplified framework from $15 billion to $20 billion in assets. This is intended to capture the entire mutual sector, while allowing for future growth and consolidation.

Features of the framework include allowing smaller ADIs to apply a flat 10 per cent operational risk charge, excluding market risk capital charges and minimising other reporting requirements, which will reduce compliance costs relative to larger entities.

This will be supported by the plan to have APRA take on the task of Pillar 3 disclosures for smaller entities, further reducing their compliance burden. I would add that the APRA Connect project – while requiring initial investment from all parties to implement – will ultimately reduce reporting burden by enabling greater automation of submission of data to APRA.

The proposed framework also seeks to improve comparability between ADIs using internal ratings-based (IRB) and standardised approaches to calculating regulatory capital, by requiring IRB banks to also report capital ratios using the standardised approach. A mortgage risk-weight floor is proposed for IRB banks, which is intended to support smaller ADIs’ ability to compete for low-risk mortgages.

As there has been some feedback on the implementation date of the proposed ADI capital framework, I will clarify that we are still targeting 1 January 2023. It is important that we hit this target, not only because the reforms have been in the works for some time, but also to give industry and investors some certainty and a base from which to plan. These are significant reforms and we expect ADIs to prepare appropriately to ensure the reforms are implemented, and ADIs are able to manage execution risks.

The processes that resulted in the proposed simplified framework is a standard approach to policy development and supervision within APRA. Equally, when we conduct data collections, APRA will continue to look for opportunities to have thresholds that exempt smaller ADIs or provide longer timeframes to reduce burden.

The industry can expect significant differentiation, where appropriate, in the design and application of our initiatives to ensure requirements are proportional and minimise regulatory compliance costs for smaller entities. The benefits will be maximised if mutuals engage with APRA, because the more we understand your business the greater our ability to adjust our requirements accordingly. There is always, however, a balance in designing differentiated requirements, as depositors should expect an equal level of safety wherever their money lies.

The challenge of change

An enhanced focus from APRA on delivering proportional regulatory requirements will have a tangible impact for mutuals, but it is important to remain realistic about the range of challenges that lay ahead for the sector. The ability to adapt and perform well across a number of areas has been demonstrated, but fundamental drivers of low interest rates and increasing information technology costs are not about to disappear.

Remaining relevant will require ongoing change. Boards and management need to recognise that, ultimately it’s up to them to do the hard work of executing a strategy that is suitable for their particular business and customer cohort.

APRA wants the sector to remain healthy and we will continue to focus on fulfilling our prudential mandate in an efficient manner and promoting sound risk management, so you can continue to be there for your customers into the future.

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.