APRA releases 2022 MySuper performance test results

The Australian Prudential Regulation Authority (APRA) has released the results of the second MySuper performance test.

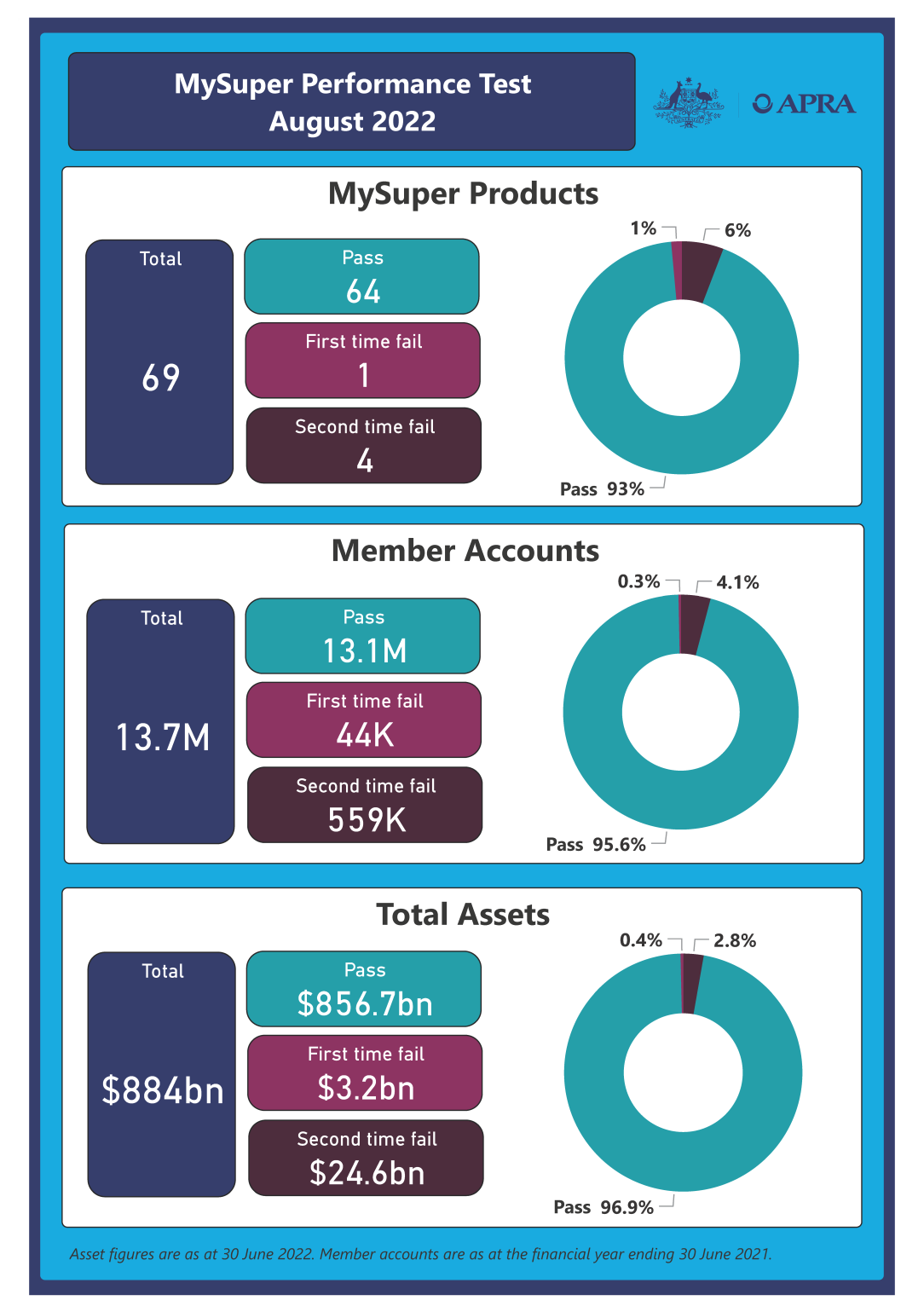

APRA assessed 69 MySuper products with at least five years of performance history against an objective benchmark that assesses two components: investment performance, and fees and costs.

Five products failed to meet the benchmark this year, including four that failed for the second time. A further five products that failed last year’s performance test passed this year.

APRA Member Margaret Cole said the overall results highlighted the improved outcomes that have been achieved for superannuation members over the last 12 months.

“Pleasingly, almost 96 per cent of MySuper superannuation members are now in a performing MySuper product, equating to 13.1 million member accounts.

“Equally positive is that the performance test has contributed to over 5.1 million MySuper members (just over 38 per cent) now paying lower fees than they were last year.

“This is the culmination of APRA’s intensified supervisory approach, driving trustees to take meaningful action to improve member outcomes. APRA encourages superannuation trustees to continue to explore ways to improve the efficiency of their MySuper products,” Ms Cole said.

Trustees of the product that failed for the first time will notify their members of the result by 28 September 2022.

The four products that failed the test for a second time are now closed to new members. Of those four products, three were offered by trustees with plans to exit the industry.

Ms Cole said plans were well underway for the over 500,000 members of those three products to transfer to new MySuper products before the 2023 performance test.

“APRA will be engaging with these trustees to ensure that members achieve better outcomes as quickly and safely as possible,” she said.

The annual performance test was introduced last year to protect members from poor outcomes and hold trustees accountable for the implementation of their investment strategy. The test assesses products’ long-term performance against a clear and objective benchmark tailored to each product’s asset allocation. In 2021, 13 MySuper products failed the test of which four have since exited.

2022 Results

The accessible version of this dashboard is available here.

Failing products

First time failing product

RSE | MySuper Product |

|---|---|

| Retirement Wrap | Westpac Group Plan MySuper |

Second time failing products

RSE | MySuper Product |

|---|---|

| Australian Catholic Superannuation and Retirement Fund | LifetimeOne |

| Energy Industries Superannuation Scheme-Pool A | Balanced (MySuper) |

| Retirement Wrap | BT Super MySuper |

| AMG Super | AMG MySuper |

The MySuper Performance Test page is available on the APRA website at: The Annual Superannuation Performance Test - 2022 | APRA

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.