APRA Member Margaret Cole - Speech to the Investment Magazine Chair Forum

Bridging the sustainability chasm

Good morning. It’s lovely to be able to join you here in Healesville after a number of false starts, and I appreciate the opportunity to meet many of you in person after a long nine months on the other side of a screen.

It is pleasing to see that your agenda over the past day or so has traversed many of the important issues that are on our minds at APRA: the future shape of the industry, decision-making in leadership, tackling thorny problems such as your role in supporting members beyond the accumulation phase, as well as confronting a challenging external environment.

It’s to the superannuation industry’s credit that it has generally performed well over the past few years in the face of several major financial and operational challenges, meeting its obligations and delivering strong returns to members. But super is a long-term investment, and how funds are placed to perform in the future is just as important as how they are performing today.

Since APRA published the results of the inaugural MySuper performance test in August last year, there has been heightened scrutiny on investment returns, fees and costs across the industry – especially for the funds that either failed the test or barely scraped through. But passing the performance test does not necessarily mean you are in clear water and have escaped the APRA radar. Arguing that “there’s nothing to see here – we passed the test” will not give you a cloak of invisibility when we consider other factors that tell the full story about a fund’s prospects of continuing to perform well into the future.

We deliver this assessment publicly each year when publishing our annual MySuper and choice heatmaps, which cover investment returns, fees and costs – and sustainability. Over the past few months we have been analysing the heatmap data for insights into the sustainability of member outcomes across the industry. Later we will publish that report, but first I intend to run you through the key findings. In short, the report finds there is a widening sustainability gap developing in the superannuation industry largely based around scale. Without urgent action that gap will become a chasm that many smaller funds will be unable to bridge, undermining their ability to deliver for members and forcing them into a merger or out of the industry altogether.

A year of transformation

Before getting onto the findings, I’d like to speak briefly about APRA’s agenda for superannuation in 2022, which we published in our annual policy and supervision priorities documents at the beginning of February.

If I could sum up our agenda for the year ahead, it would be “transformation driven by action”. The last six months of 2021 gave a strong taste of what this will look like, with APRA in effect directing several trustees of underperforming funds to pursue a merger. That muscular approach will continue this year as APRA seeks to further transform the industry to one where:

- the focus on members’ best financial interests brings new and valuable discipline to trustee decision-making;

- transparency flows beyond MySuper products into the choice landscape, with poor performance in any superannuation product having nowhere to hide; and

- innovative retirement income products begin to move from an aspiration towards a reality.

Transformation must also necessarily involve the composition of the industry.

Although fund consolidation has been underway since at least 2013, and has sped up substantially in the past few years – with APRA aware of at least 10 mergers under formal discussion – there are still too many funds and products on the market. Beyond the confusion it causes members, we see far too much duplication in design and strategy, which is inefficient and contrary to the functioning of a vibrant competitive market and contrary to the best financial interests of members.

The problem isn’t just the number of funds and products on the market – it’s the shape of the industry, which is awkwardly skewed with regard to membership and funds under management. It is no secret that the superannuation industry has a very long and concerning tail. Of the 136 APRA-regulated super funds as at 31 December 2021, 96 funds have less than $10 billion in assets under management, and 63 of those have less than $2 billion. To put that in perspective, the country’s largest super fund is growing by around $20 billion – 10 times that amount – every year. When it comes to growth, it’s clear that standing still is going backwards.

The scale of the problem

The theory of why scale is crucial in the delivery of member outcomes in superannuation is well known. Not only will members typically receive the benefit of lower fees, but larger funds with economies of scale will likely provide better long-term retirement outcomes. The significance of the paper APRA is releasing shortly is that it presents hard evidence proving that lack of scale not only hinders performance now – it undermines the ability of funds to deliver sound member outcomes in the future.

The paper outlines APRA’s key findings from our analysis of the sustainability of member outcomes covered in the MySuper Heatmap and Choice Heatmap we published last December. What we have found is that the trustees of the largest superannuation funds are leveraging their scale and structure to lower expenses and improve operating efficiency. Specifically, across funds assessed in the heatmaps, we found that the administration fees and operating expenses of the large funds with net assets greater than $50 billion are significantly less than that of the small funds with net assets under $10 billion – 0.33 per cent of net assets compared to 0.57 per cent.

More concerning, we have found that half of small funds (with assets under $10 billion) face sustainability challenges with declining net cash flows and member accounts.

Consider this one metric – net cash flow ratio.

Net cash flow ratio

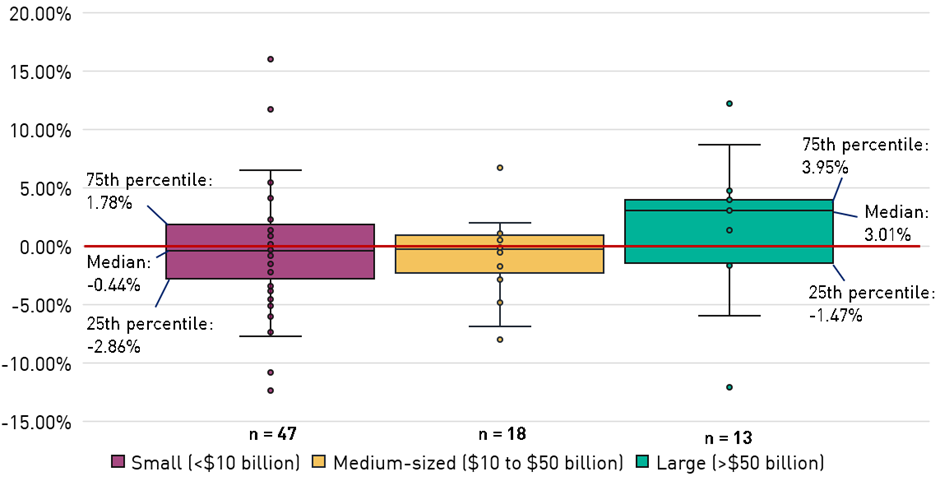

Figure 1. 3-year average net cash flow ratio by RSE size (at 30 June 2021)1

This graph shows that the largest funds (greater than $50 billion) are capturing an increasing share of system-level cash flows. As funds get bigger, they collect more fee revenue from members through asset-based fees, thereby increasing their budgets and financial capacity to invest in improving outcomes. As to whether the charging of asset-based fees by large funds on this basis remains appropriate as operational efficiencies through scale are achieved, this remains an open question.

The smallest funds (with assets under $10 billion) are facing the most adverse trends in net cash flows. Even medium-sized funds (in the $10 billion to $50 billion range) generally displayed negative trends, with only six funds having positive net cash flow ratios. Unless they can reverse those trends, many, if not most, of these smaller funds will likely face challenges in addressing underperformance, such as high fees and poor investment returns for members.

Interestingly, independent research by SuperRatings conducted for APRA found that with scale, administration expenses as a percentage of fund assets (and hence total administration fees) ought to gradually reduce, even without efficiency gains. Total MySuper fees are expected to fall, driven by further fund consolidation and scale efficiencies. SuperRatings’ forward-looking analysis indicated that median administration fees in MySuper can reduce further by 10 to 20 per cent. SuperRatings recommended a 30 basis point benchmark for MySuper products (total administration fees as a percentage of MySuper assets), which APRA should review over time to ensure that the benefits of increased scale are passed on to members.

Crossing over

While our report identifies the problems, it also points trustees towards a range of options that they can adopt to improve short-term performance and boost member outcomes.

Of the 19 MySuper products that closed since APRA’s first heatmap in 2019, 15 have merged and four closed as a result of trustees consolidating their product offerings. The merged funds delivered a combined annual savings of around $21 million for 350,000 members (or $60 per account). Significantly, mergers that involved large funds delivered the greatest fee savings, especially in administration fees of nearly 2.5 times2. The four products that closed as a result of product consolidation delivered fee savings to 780,000 member accounts of $20 per account.

This is welcome news for those members, but the reality is that no fund with under $10 billion in assets is going to become a $50 billion plus fund through business efficiencies alone. The only way to make that kind of jump is through a merger – ideally with a well-performing fund.

APRA has also been vocal in discouraging smaller funds facing sustainability challenges from what we’ve described as “bus-stop” mergers. The merger of two small funds to create a mid-range fund might be an improvement, but it’s not a final destination for members; ultimately, the new entity is likely to need to find another partner down the road. As APRA has stated before, trustees have a duty to serve their members’ best financial interests – not simply better them. The difference might seem subtle but it’s crucial.

A gulf in leadership

Interestingly, we did find a sub-set of small funds that consistently bucked the sustainability trend, and were managing to grow. These funds generally provided specialised offerings, such as environmental, social, governance (ESG) focused products. This finding harks back to my earlier point about duplication; the small funds that are performing best typically have developed a point of difference that distinguishes them in the market.

This brings me to the subject of governance, which is the key to rectifying sub-standard practices.

In the nine months since I took up my role at APRA, one of the observations to have struck me most sharply is the disparity in board capability across the sector. I have seen boards with very high-quality members operating effectively and focused on the best financial interests of members, and others where capabilities and practices are not to the standard required in this industry, and where directors seem blissfully untroubled by the potential adverse impact on their members’ retirements of their skills gaps and inaction.

APRA has observed that, under ongoing sustainability pressure, not all funds have the mature governance needed either to navigate to a stronger position or recognise the need to serve the interests of their members by merging or exiting. Sometimes this is related to skills and experience at board level, which is why a healthy turnover of directors is essential. A key question that every chair needs to ask is: “Do we have the right capabilities and skills for the future of the fund?”

But maturity also refers to the ability to put egos and personal agendas aside and act – as trustees are legally required – in the best financial interests of their members. The path to a merger is not always straight-forward, and there are barriers that need to be overcome, such as due diligence costs, finding a suitable (and willing) partner and the application of the equivalent rights test. These are legitimate issues, and APRA is working with industry to better understand how these hurdles can be more easily overcome.

Rather less legitimate are other regrettably common barriers to merging, such as protecting jobs on the board, preserving payments to sponsor organisations, or petty feuds and rivalries. Trustee boards are no-one’s personal fiefdom. At all times, trustees must act in members’ best financial interests, and in some cases that will mean pragmatically – even reluctantly – concluding that members will be better served in another fund or product. Serving as a trustee is a privilege, not a right conferred by extraneous circumstances.

APRA cannot directly force even the poorest performing, least sustainable fund to merge, but we have shown a willingness to use the extent of our powers to push certain funds towards this end. You can expect that bias towards action from APRA to continue into the future.

Mind the gap

In today’s world – a world that seems to be moving ever faster and where almost anything we want can be accessed instantly – it’s easy to become fixated on the here and now. But outcomes in superannuation aren’t determined in an instant – they are developed over years of careful management and intended to serve members for decades in retirement. While it is better to pass the performance test than to fail, it’s not enough to guarantee good outcomes for your members in the years ahead.

APRA’s analysis of sustainability in superannuation clearly demonstrates that larger funds are, in general, better equipped to deliver their members higher net returns and lower fees over the long-term. It shows the gap between the big and small ends of the industry is getting wider, making it ever harder for small funds to keep pace with rivals that enjoy far greater efficiencies and economies of scale. Encouragingly for small funds facing sustainability challenges, our analysis also shows that a merger with a suitable partner can deliver almost instant and ongoing benefits to members, and the bigger the receiving fund, the greater the benefits.

APRA may not be able to direct a merger, but nor should we need to. We should not need to substitute our decision-making for yours. As trustee chairs and directors, your obligation – moral, fiduciary and legal – is to protect your members’ best financial interests. To recognise that someone else can do that better than you and act accordingly is not an admission of weakness or failure – it is a sign of good business leadership and genuine care for your members.

Footnotes

1 Figure excludes Future Super Fund (36.10%), DIY Master Plan (46.75%), Australian Defence Force Superannuation Scheme (55.36%) and Grosvenor Pirie Master Superannuation Fund Series 2 (25.21%) due to large net cash flow values.

2 $48 per member account for mergers involving large RSEs compared to $20 for other mergers

Media enquiries

Contact APRA Media Unit, on +61 2 9210 3636

All other enquiries

For more information contact APRA on 1300 558 849.

The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. APRA currently supervises institutions holding around $9 trillion in assets for Australian depositors, policyholders and superannuation fund members.