APRA policy priorities: Interim update - September 2021

In February 2021, APRA published its annual update on the prudential policy agenda. In response to industry feedback on specific policy consultations and in light of COVID-19, APRA has reprioritised the policy agenda for the remainder of the year.

This reprioritisation is intended to enable APRA-regulated entities to focus on implementing key policy reforms, as well as managing the impacts of COVID-19. For certain prudential standards, the effective dates have also been delayed, providing more time for planning and preparation before they come into force.

Policy Priorities in 2021

In the fourth quarter of 2021, APRA’s policy priorities will centre on completing key reforms to strengthen financial resilience. The priorities will be:

- Completing the bank capital reforms, with three final standards for capital adequacy to be released in November 2021 and to apply from January 2023;

- Consulting on reforms to the insurance capital framework to reflect changes in the accounting standard AASB 17, update LAGIC and align PHI with other industries;

- Consulting on new standards for financial contingency planning and resolution, to be released in November 2021 for an extended consultation; and

- Updating superannuation standards for Insurance in super and Investment governance, ahead of a more comprehensive review of other key standards next year to ensure a sharper focus on the best financial interests duty.

APRA also plans to release final guidance on managing the financial risks of climate change and, in line with previous recommendations from the IMF FSAP and APRA Capability Review, an Information Paper setting out APRA’s framework for the use of macroprudential policy tools.

Several other policy releases originally scheduled for this calendar year have been deferred to 2022, including standards for operational resilience, remuneration disclosure requirements, interest rate risk in the banking book and offshore reinsurance.

Next steps

An updated schedule of policy priorities for 2021 is outlined in Annex A, highlighting those that have been deferred to next year. In line with the normal annual cycle, APRA will provide a full update on the policy agenda for 2022-2023 early next year.

Yours sincerely,

Renée Roberts

Executive Director

Policy and Advice

Annex A. Policy timelines

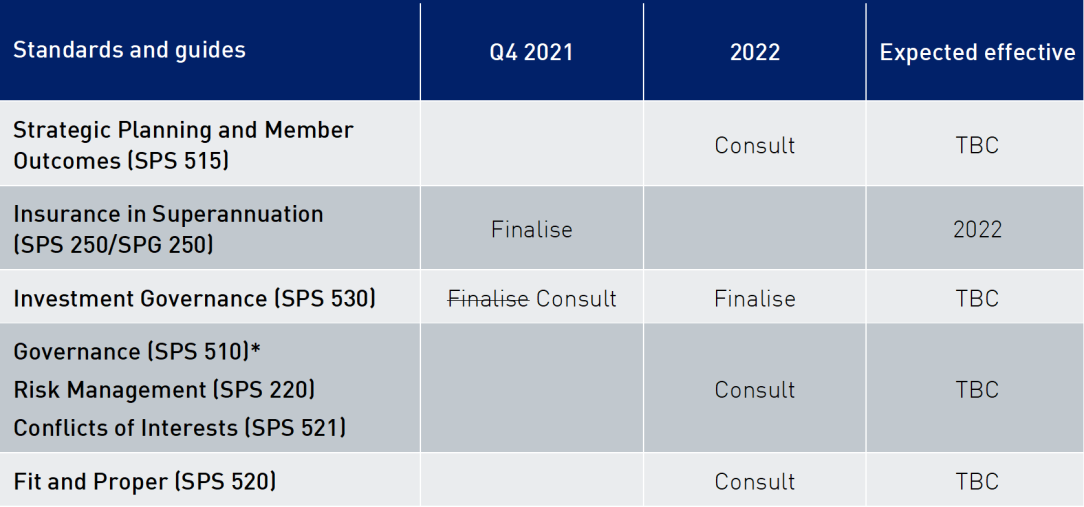

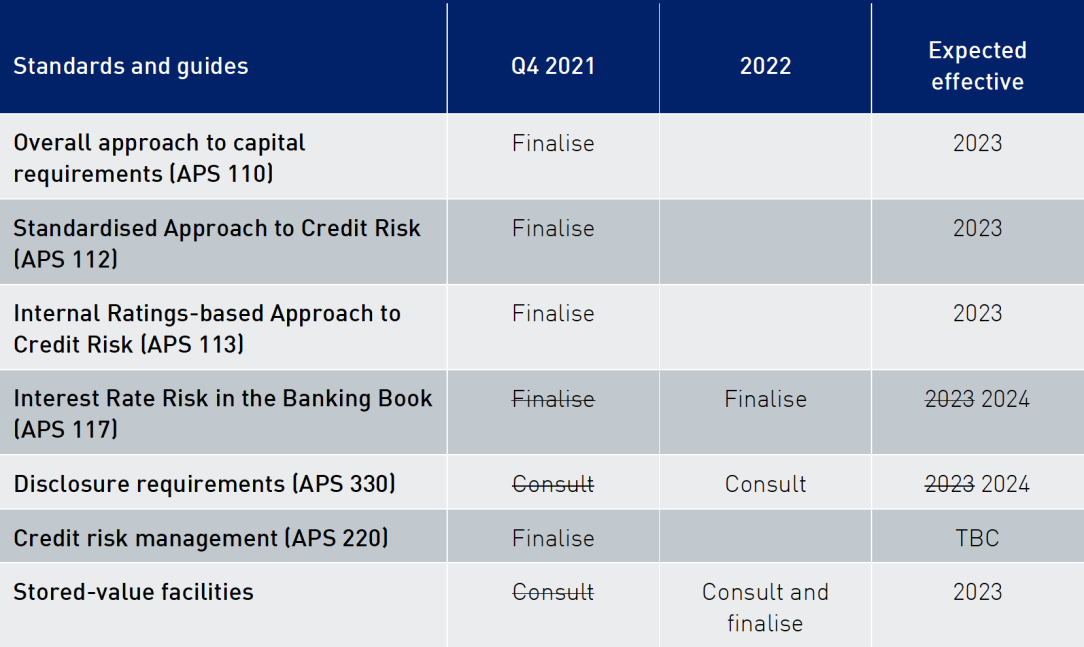

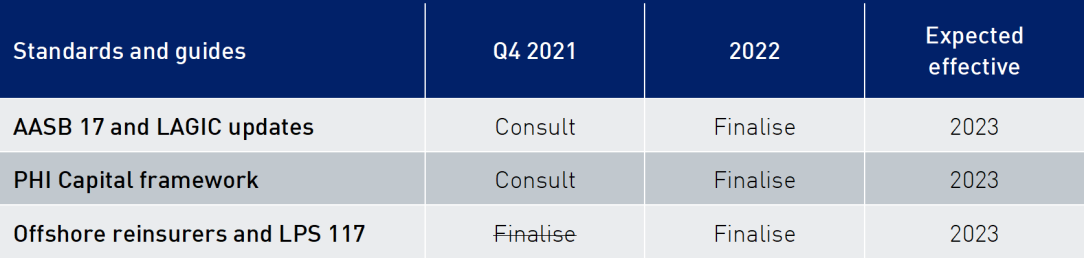

The timelines below summarise the APRA policy priorities for the fourth quarter of 2021, and those that have been deferred to 2022. The tables do not include new policy development for 2022-23. APRA will publish a full update on policy priorities early next year.

Cross-industry

Banking

Insurance

Superannuation