APRA Insight - Issue 3 2017

2016 general insurance stress test

APRA conducted its first industry stress test of general insurers in 2016. The exercise formed part of APRA’s stress-testing program which has primarily focused on the banking sector in the past but is now including other regulated industries. This broader focus included a stress test of life insurers conducted in 2015.

The increased focus on stress testing by APRA reflects the broader, increased use of stress testing by financial institutions and other regulators since the global financial crisis. APRA’s stress-testing program complements its risk-based supervision and the prescribed capital rules which are applied to the institutions it regulates, by enhancing capital management practices and informing recovery planning. Unlike the regulatory stress-testing programs in some other jurisdictions, APRA does not publish stress test results of the individual participants nor does APRA use these results to set capital requirements.

The participants in APRA’s first general insurance stress test were limited to the four largest direct insurers and two largest reinsurers in the Australian market. A key objective of the exercise was to provide the boards and senior management of these insurers, as well as APRA, with a view of the capital resilience of the participants in two severe, but plausible, scenarios. The exercise was also useful for assessing insurers’ stress-testing capabilities and supporting the further development of these, and to assist in the identification of emerging risks.

This article provides a summary of the stress test results and outlines some of the better practices in stress-testing capabilities observed among the participants. Through sharing these better practices, APRA seeks to further the development of robust stress-testing frameworks among those insurers and reinsurers which did not participate in this stress test.

Scenarios

The two hypothetical stress test scenarios were designed to test the impact of key risks in a stressed operating environment. Each scenario took place over a three-year time horizon and comprised two sources of stress: an economic stress which was common to both scenarios and individual insurance stresses. The economic stress involved a downturn in the Chinese economy leading to a fall in global growth and a recession in the Australian economy, which included gross domestic product (GDP) falling by 3.5 per cent and unemployment increasing to 8.9 per cent. The insurance stress in the first scenario (‘Scenario A’) involved an earthquake in Sydney which led to a large accumulation of claims, while the second scenario (‘Scenario B’) included a large increase in claims costs in the liability classes of business, mainly in the NSW compulsory third party (CTP) motor scheme.

Results

The capital impacts of the stress test varied considerably across the participants due to the heterogeneous nature of the direct insurers and reinsurers involved. The stress test results provided valuable insights into the relative susceptibility of the participants to capital stress when subject to the two common scenarios.

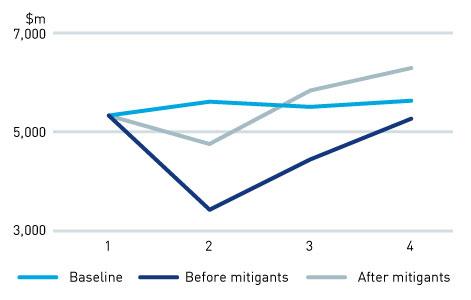

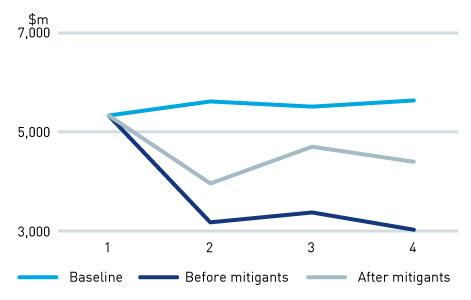

figures 1 and 2 show the impact of the scenarios on the aggregate surplus capital of the participants when compared with their unstressed surplus capital forecasts (‘baseline’ results). The most severe impacts from the economic stress were in year one with substantial widening in credit spreads and falls in equities values. This resulted in large investment losses being reported by those participants with exposures to lower rated interest rate investments and equities. The economic stress in year one also produced large increases in consumer credit and trade credit claims costs for some participants.

The aggregate surplus capital was aided by a recovery in the investment markets in years two and three, with investment gains reported by some participants from a narrowing in credit spreads and a strong recovery in the values of equities.

Figure 1: Aggregate surplus capital (Scenario A)

Figure 2: Aggregate surplus capital (Scenario B)

Reinsurance and retrocession arrangements played an important role in reducing the impact of the stresses. In Scenario A, the gross losses from the earthquake, which took place in year one, were well below the upper limits of these arrangements, so direct capital impacts from this stress were relatively small. The design of Scenario B meant that losses from the liability stress increased gradually over time with the most severe impact being recognised at the end of year three. Most of the participants did not have proportional or stop loss reinsurance in place to reduce the impact of the increased volume of claims which led to a more sustained fall in aggregate surplus capital.

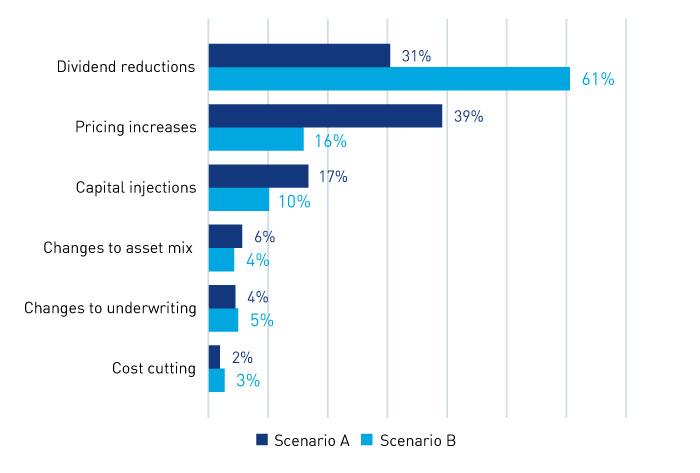

The stress test also offered insights into the mitigating actions which the participants would look to employ in times of capital stress. Figure 3 illustrates the contribution of mitigating actions to increases in the aggregate surplus capital which were reported in the results after mitigating actions. Actions were generally well considered with participants tailoring them to reflect the size and timing of capital impacts resulting from the different stresses.

Figure 3: Mitigating actions

Examples of better practice involved a thorough assessment of the potential effects of the stresses and mitigating actions on key stakeholders, including shareholders and customers. Among some of the participants that are part of global insurance or reinsurance groups, this involved assessing the potential impact of a global economic stress on the capital position of their group parents, and thus the capacity of the parent shareholder to provide capital support to them. Better analysis of premium rate increases considered competitor responses and strategies to keep premiums affordable and limit losses of business to competitors.

Stress-testing governance and capabilities

All participants demonstrated sound governance arrangements including strong oversight by executive board committees, and discussion and challenge of the stress test results and mitigating actions by senior leadership teams. Effective and appropriate engagement was also evident in the range of staff used by participants to assess and quantify the impacts of the stresses and the efficacy of mitigating actions; these included underwriters, claims staff, asset managers, finance, and risk management staff. This inclusive approach facilitated the use of professional judgements from business experts and, in some cases, first-hand experiences of recent historical events such as the global financial crisis and the Christchurch earthquakes as part of the process.

While modelling capabilities were generally fit for purpose, the participants’ involvement in the stress test resulted in them identifying areas for improvement. These included enhancing their modelling processes to assess the capital impacts of stresses taking place over a multi-year time horizon, rather than a one-year time horizon which has often been the normal practice. Furthermore, for the stress in the CTP class of business, APRA supplied participants with claims frequency and claims size data to illustrate the key drivers of the stress. Requiring this approach to be taken in modelling the APRA stress provided participants with a different way of considering their usual modelling processes which normally involve less granular loss factors.

APRA also found there was scope for improving the modelling of economic stresses among participants. The challenge in modelling these stresses is that recent economic downturns in Australia have not been severe when compared to the experience in other countries. This means there is limited local historical loss data available to assess and model the impact of very severe downturns on insurers’ claims experience and the demand for insurance products. In response, some of the participants that are part of global groups leveraged the experience of overseas business units, especially in the United States during the global financial crisis, when assessing these impacts. Considering this type of relevant, overseas experience in their stress testing challenges insurers to broaden their thinking on the potential impacts of very severe economic downturns and not limit this thinking to local historical experience.

Given the inherent uncertainty in the outputs produced by stress test modelling, APRA’s view is that most participants’ results would have benefited from a greater use of sensitivity analysis to highlight the impact of key assumptions and parameters. An example of this presented by some participants was an analysis of the earthquake stress which included the potential loss impacts for different earthquake depths and locations in Sydney. This type of analysis could also be applied to stresses in the liability classes, highlighting the sensitivity of results to assumptions such as inflation.

An important part of stress-testing is the assessment of a full range of potential impacts arising from the stresses, including the effects on business operations. In the APRA stress test, only a few of the participants considered these operational impacts, including implications for business continuity management, the mobilisation of claims staff to manage an increased volume of claims, and impacts on supply chains.

Next steps

APRA anticipates that the stress test participants will look to continually improve their capabilities, with their involvement in the APRA stress test highlighting areas for further consideration.

APRA has sought to promote the development of stress-testing capabilities more widely and providing examples in this article of better practice identified through the stress test is one part of this. APRA has also shared the stress test scenarios and parameters with other APRA-authorised insurers for consideration in their individual 2017 Internal Capital Adequacy Assessment Process (ICAAP). These insurers are not expect to provide separate stress test results to APRA but instead should include the results in their ICAAP reporting if the scenarios are relevant to their own exposures and risk profiles.

The general insurance industry can expect APRA to continue its focus on stress-testing, with the next industry stress test scheduled for 2019.

Refreshing APRA’s approach to licensing

Licensing plays an important role in APRA’s oversight of the prudentially regulated industries of banking, insurance and superannuation. APRA seeks to ensure that only sound institutions enter these industries, to maintain financial stability and protect depositors, policyholders and superannuation fund members.

In recent years, an increase in innovation and technology-driven products and services has seen the introduction and growth of non-traditional companies seeking to provide financial services. Against this background, APRA has refreshed its licensing framework with the establishment of a centralised licensing team, and proposed a phased approach to licensing for authorised deposit-taking institutions (ADIs).

The centralised licensing team was established in July 2017. It oversees APRA’s licensing activities to ensure they are suited to the increasingly diverse range of applicants seeking to be licenced by APRA. APRA envisages that the greater consistency and efficiencies that will be achieved with a centralised licensing process will benefit all applicants. Whilst the licensing team is the initial point of contact for applicants, APRA’s frontline supervisors and risk specialists will still be involved in assessing applications. Early feedback indicates this centralised licensing model provides applicants with clearer engagement with APRA.

Introducing a phased approach for banking entrants

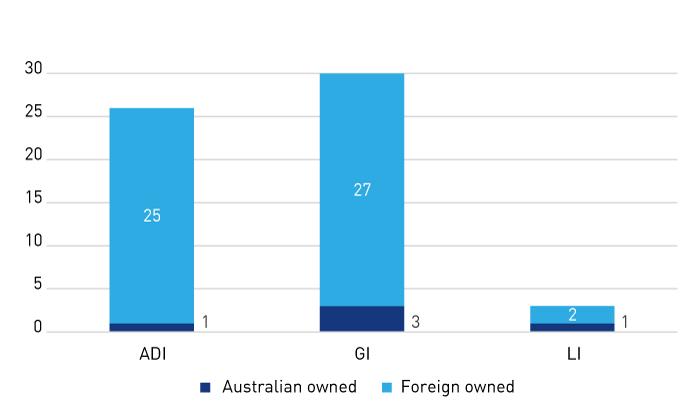

For the 10 years prior to June 2017, APRA granted licences to 26 new ADIs, and one of these was an Australian owned company (figure 1). With the exception of the Australian-owned entrant, all were foreign bank branches that have restrictions on business with retail customers.

Figure 1: Authorisations in the past decade

In August 2017, APRA released a discussion paper1 on proposals to introduce a phased approach to authorising new entrants to the banking industry. The phased approach is designed to make it easier for applicants, particularly those with innovative or otherwise non-traditional business models, to navigate the licensing process, while at the same time maintaining overall entry standards. This approach may also bring new sources of competition by allowing new entrants time to establish the full complement of resources and systems necessary to comply with all aspects of the prudential framework.

The process for applicants has been split into two phases: the Restricted ADI licence, and the transition to a full ADI licence. Applicants that are eligible for the Restricted ADI licence are required to meet some parts of the prudential framework upfront, such as fit and proper standards and minimum capital of $3 million. They must also have a strategy to meet the full prudential framework within two years, and a plan to allow for an orderly exit from the industry should this need eventuate.

Restricted ADIs must transition to an ADI licence within two years by building their resources and capability to meet all of the prudential requirements proportionate to the size and complexity of their business. During this period restrictions apply, such as on aggregate and individual customer deposits, minimum capital and liquid holdings, as well as certain disclosure and reporting requirements.

The Restricted ADI licence is expected to suit companies with non-traditional business models looking to enter the banking industry. It will allow these applicants to become a licenced entity at an earlier stage whilst building their capability to meet all of the prudential requirements. This gives the entity exposure to their target market and provides some impetus for potential investors. However, applicants on a Restricted ADI licence will not be able to actively conduct banking business until they are out of the restricted period.

Exit planning within the restricted period

An important feature of the Restricted ADI licence is the requirement for submission of a credible exit plan and strategy to meet the prudential framework as part of the application. During the restricted period, APRA will focus on the applicant’s ability to meet the prudential framework within the maximum two-year restricted period. Some Restricted ADIs may not need the two-year period before they progress to a full ADI licence. However, if a Restricted ADI cannot meet the prudential framework within this time, APRA will revoke its licence. The exit plan is therefore an essential part of the Restricted ADI phase as its purpose is to provide options for an orderly exit from the banking industry. APRA’s focus will be to ensure that deposit-holders will be repaid in full without the need to activate the Financial Claims Scheme2 or for APRA to use its powers for managing failures.

New entrants to the banking industry

Since its inception, the licensing team has had discussions with a range of parties who are interested in APRA’s phased approach to licensing ADIs. These parties range from existing businesses that are looking to expand into banking business to new start-ups (including fintechs). Most of the parties APRA has met are looking to provide transactional banking services and simple lending products targeted at the millennial generation via innovative mobile applications. Others have a more traditional business model targeting niche lending markets.

APRA expects the phased approach to ADI licensing will assist in providing a greater range of products and services for consumers. Whilst potential applicants tend to have a narrowly focused business model, an increase in the number of ADIs should nevertheless promote competition within the industry.

Conclusion

The introduction of a phased approach facilitates new entities entering the banking industry. This should assist with increasing competition and new services being offered to consumers. At the same time, the restrictions being applied ensure that standards and expectations for regulated entities are not unduly weakened. APRA also expects that any exit from the Restricted ADI population would have minimal impact on the stability of the Australian financial system.

Since releasing the discussion paper, APRA has engaged with a diverse range of parties and potential applicants ranging from fintech companies to niche lenders. Whilst APRA is business model agnostic, the intention of a phased licensing approach for ADIs is to facilitate competition and innovation in the banking industry.

To date, this proposal has been well received and a number of potential applicants are in discussions with APRA to take advantage of this new approach. APRA is looking to finalise the formal Restricted ADI licence guidelines in the first half of 2018, but that does not prevent APRA from working with potential applications in the meantime.

1 Consultation on phased licensing for authorised deposit-taking institutions.

2 https://www.apra.gov.au/

Strengthening actuarial advice within insurers

APRA’s plan to refine and strengthen the role of the Appointed Actuary entered a new phase last month with the release of a Response Paper for further insurance industry consultation and engagement.

APRA values the position, and relies on the skill, expertise and judgement of Appointed Actuaries. However, as the financial system evolves and new risks emerge, APRA believes it is essential that the Appointed Actuary framework is enhanced to optimise its effectiveness and better safeguard the interests of policyholders.

In June last year, APRA issued a Discussion Paper making a series of proposals, at a principles level, to increase flexibility, streamline requirements and emphasise the seniority of the Appointed Actuary role within insurers. Prompting the move were concerns held by APRA, particularly regarding the life insurance sector, about increasing turnover of Appointed Actuaries, reduced average tenure, difficulties finding suitable candidates and decreasing levels of seniority within the companies they operate.

At a time when life insurers faced significant challenges, and all insurers were grappling with ongoing low investment returns, APRA sought to establish whether Appointed Actuaries were being listened to as closely as they should be – and if not, how that could best be addressed.

Concluding that improvements were necessary, APRA’s Response Paper outlined a range of measures aimed at ensuring the role remained on a sustainable footing into the future.

Purpose and flexibility

Central to APRA’s response to industry feedback is a proposed Purpose Statement on the role of the Appointed Actuary. Embedded in the statement are two key principles: the Appointed Actuary should provide boards and senior managers with unfettered access to expert, impartial actuarial advice; and the Appointed Actuary must have sufficient authority and seniority to influence and, if necessary, challenge board and management decisions.

With that Purpose Statement as an important foundation, APRA intends that the updated actuarial framework should, where possible, include increased flexibility to allow insurers and actuaries to design an actuarial advice model that best suits their business needs. On the commonly-asked question of whether the Appointed Actuary should be internal or external, APRA has indicated it is comfortable with either approach so long as the model achieves its purpose. Likewise, APRA received submissions arguing both for and against the proposition that Appointed Actuaries should report directly to the CEO. APRA has seen examples of both structures working effectively, and hence has not seen a need to be prescriptive in this area.

Although APRA recognises that actuarial advice can be provided by actuaries who are not the Appointed Actuary, a proposed materiality policy will ensure the Appointed Actuary is relied upon for those decisions most material to the business and its policyholders. Furthermore, boards must consult the Appointed Actuary both in designing their actuarial advice framework and making any material changes.

Managing conflicts

The move towards greater flexibility acknowledges that many different approaches to actuarial advice can ensure prudential standards are met across a diversity of structures, business models, resource levels and industry circumstances. Some critical issues remain, however, especially in the area of conflicts of interest. APRA’s response paper contains a greater emphasis on managing this challenge, which can arise when actuaries are effectively required to review or challenge their own work. In particular, APRA prohibits dual-hatting the roles of Chief Risk Officer and Appointed Actuary, as unmanageable conflicts can arise between these roles.

APRA’s Discussion Paper also seeks to simplify and streamline the reporting obligations of the Appointed Actuary. The Actuary’s Financial Condition Report should be focused on issues that are material and relevant to the insurer. Changes are also proposed to the Insurance Liability Valuation Report (ILVR) currently required of general insurers. This includes removing the requirement for it to be submitted to the board in every case, and extending the concept to life insurance. The ILVR will be renamed the Actuarial Valuation Report (AVR) as part of the package of changes, to more appropriately reflect is scope.

The initial impetus for this review of the Appointed Actuary’s role came from the life insurance industry, but APRA sees the role of the Appointed Actuary as being similar and fundamentally important across all insurance sectors. As a result, APRA is proposing a single cross-industry framework on actuarial matters, supported by a common practice guide. While respecting that industry-specific details should remain in some areas, APRA believes insurers and actuaries from all sectors – and especially those operating across sectors – will benefit from this consistent approach.

With this in mind, private health insurance has now been brought into APRA’s review. Given the principles and processes being proposed may also benefit PHI, APRA included a dedicated chapter on private health insurance in its recent Response Paper, marking the start of formal consultation with that sector. Stakeholders have already raised with APRA their support for the current notifiable circumstances regime. From APRA’s perspective, that system is working effectively and could be an appropriate way of meeting the proposed new standards.

What’s next?

Consultation on the Response Paper remains open until mid-December, and APRA is keen to use this period to engage further with the insurance industry to ensure its proposed new approach meets its core objectives. The new standards are expected to be finalised in the first half of 2018, after which APRA will set a date for them to come into effect, including an appropriate transition time.

Essential to the success of the new regime is cooperation and engagement between APRA, actuaries and insurers. All have an important part to play in ensuring the role of the Appointed Actuary is on a sustainable footing. Insurers must continue to consider how they position the Appointed Actuary within their corporate hierarchy, and whether that allows the role to fill its required purpose. Appointed Actuaries need to engage with the opportunity afforded by these revisions, while changes to the profession’s own standards may be necessary.

The crucial role performed by Appointed Actuaries supports APRA’s mandate by acting as another layer of protection for the Australian community’s financial interests. APRA believes these reforms will reinforce Appointed Actuaries in that important role.